We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

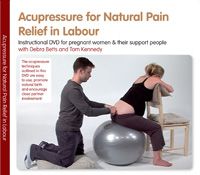

Acupressure for Natural Pain Relief in Labour - ten pack

Debra Betts has taught acupressure to promote a better birth experience to midwives, practitioners and pregnant women for many years. Now - at last - this professionally produced DVD offers a detailed explanation, fully demonstrated, of the techniques involved. Ideal for practitioners of acupuncture, acupressure, shiatsu and massage, doulas, birth helpers and pregnant women, the DVD includes testimonials from women and their partners who have used the techniques during labour and a 16-page printed booklet that sits in the DVD pack with illustrated reminders of the points and their application.

Debra Betts is an acupuncturist and educator based in Wellington, New Zealand. She has been teaching women, their support people and midwives the techniques demonstrated on this DVD since 1992. Her teaching of acupressure has in this time spread from classes held in her private clinic to international acupuncture and midwifery workshops.

Tom Kennedy is an acupuncturist based in Bristol, UK. He has a special interest in treating pregnancy related conditions, and teaches Debra’s acupressure techniques to pregnant women and their support people.

- Running time: 34 minutes

- Language: English

- Aspect Ratio: 16:9

- FHA Format: PAL

- Region: 0

- Classification: E (exempt from classification)

- About Acupressure

- Using acupressure appropriately

- A few words for support people

- How to find the eight acupressure points

- Using the points effectively

- Baby in breech or posterior position

- Failure to progress

- Emotional stress during labour

- Nausea, afterpains, breastfeeding, postnatal recovery and other problems during and after pregnancy

| Author | Debra Betts & Tom Kennedy |

|---|---|

| Publication Date | 1 Jan 1970 |

| Publisher | JCM Ltd |

* Orders shipped outside of Europe are eligible for VAT relief and will not be charged VAT.